The RENOVA Group understands that the response to climate change is one of its priority management issues.

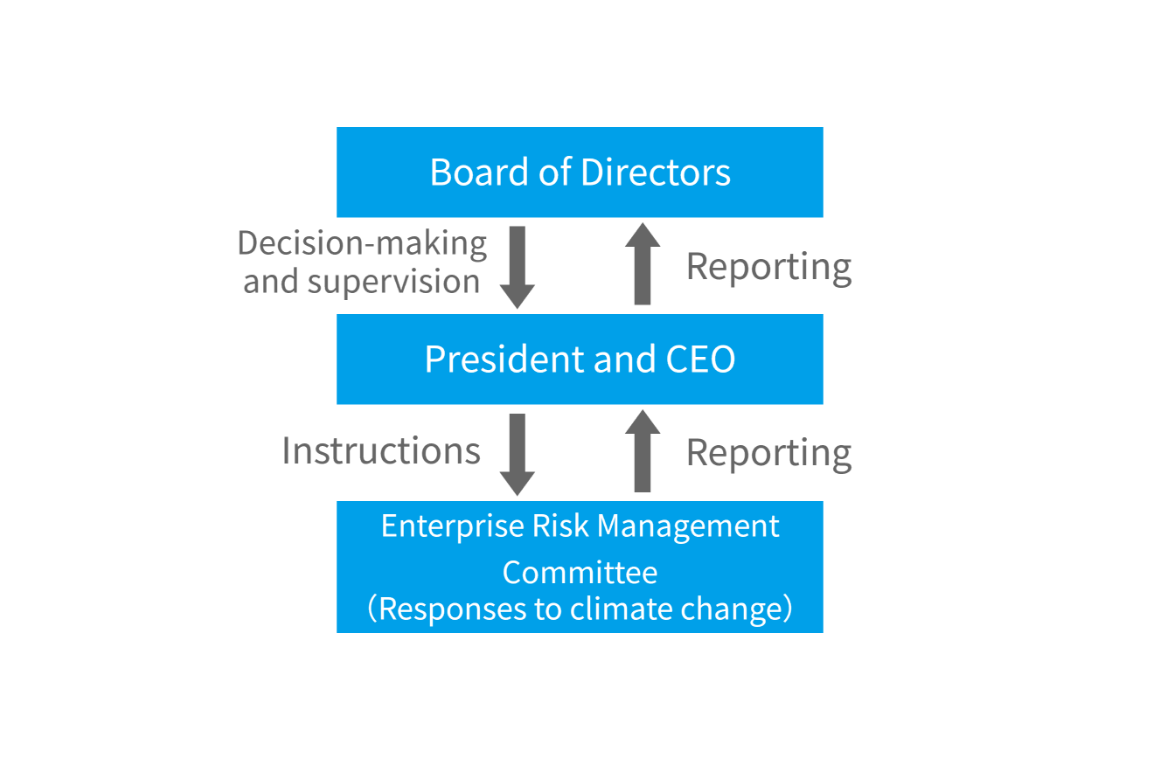

As with managerial matters, the Board of Directors is responsible for supervising and making decisions regarding projects involving climate change issues.

In the Risk Management Committee, the directors and executives led by the President and CEO shall formulate an action plan for responding to climate change risks and opportunities and discuss the details of the activities.

Disclosure in Line with TCFD Recommendations

Background to the Initiative

-

The Task Force on Climate-related Financial Disclosures (TCFD) recommendations, announced in June 2017, encourage companies to disclose climate-related financial information to help investors make appropriate investment decisions.

-

RENOVA expressed its support for the TCFD recommendations in December 2021, and requested to be listed on the Prime Market of Tokyo Stock Exchange, Inc. (TSE) in line with the TSE’s transition to new market segments on April 4, 2022.

-

The Prime Market is a new market segment based on the concept of a market “for companies which have appropriate levels of market capitalization (liquidity) to be investment instruments for many institutional investors, keep a higher quality of corporate governance, and commit to sustainable growth and improvement of medium- to long-term corporate value, putting constructive dialogue with investors at the center.

-

RENOVA also strengthen its corporate governance and adopt the TCFD recommendations as a benchmark for the verification of its response to climate change in its management.

Governance Relating to Climate Change

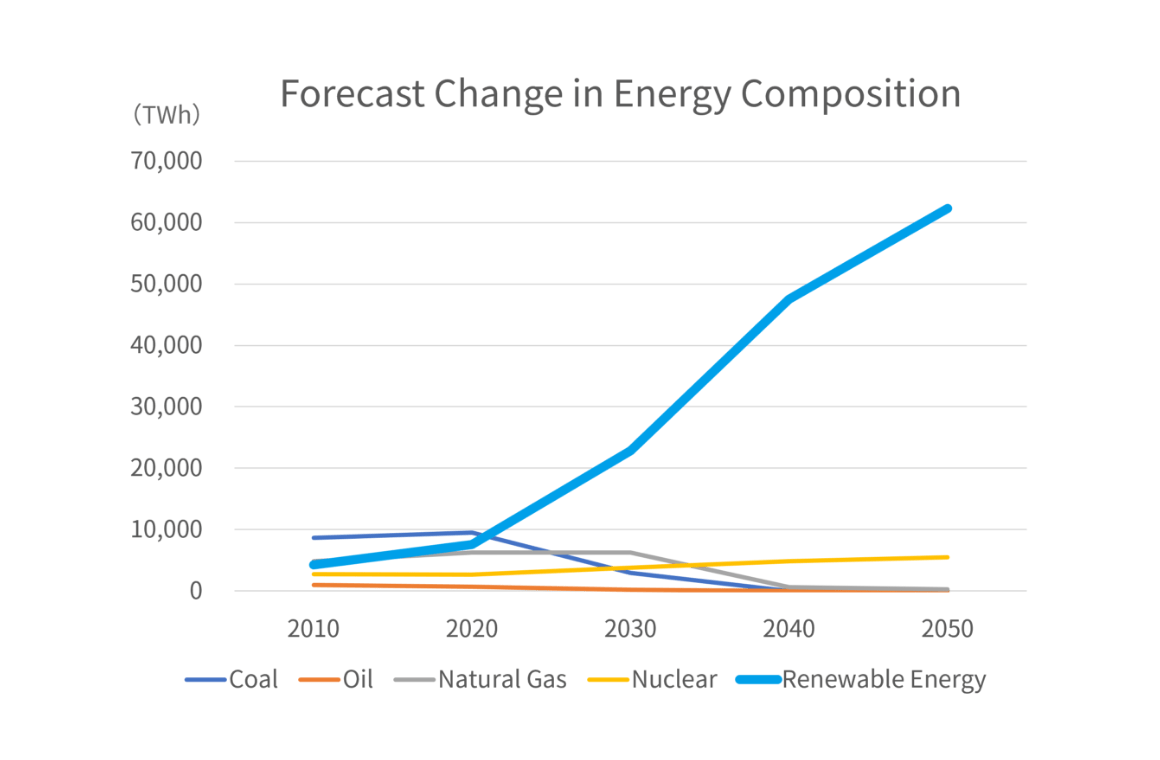

Forecast Changes in Energy Composition in the Net Zero Emissions (1.5 °C) Scenario

According to the Net Zero Emissions by 2050 Scenario (NZE), announced by the International Energy Agency (IEA) in October 2021 to provide a pathway toward limiting the global median temperature rise since the industrial revolution to 1.5 °C, about 88% of global electricity usage will come from renewable sources by 2050.

Using the scenarios created by external agencies as a reference, RENOVA will update its approach to respond to the latest developments as needed and further deepen its analyses.

Remarks: See the IEA’s World Energy Outlook 2021 (October 2021)

Recognition of Risks and Opportunities

| Category | Details | |

|---|---|---|

| Transition risks | Policies and legal restrictions |

|

| Technology |

|

|

| Market |

|

|

| Reputation |

|

|

| Physical risks | Acute |

|

| Chronic |

|

|

| Transition opportunities | Resource efficiency |

|

| Energy sources |

|

|

| Products and services |

|

|

| Market |

|

|

| Resilience |

|

Strategy

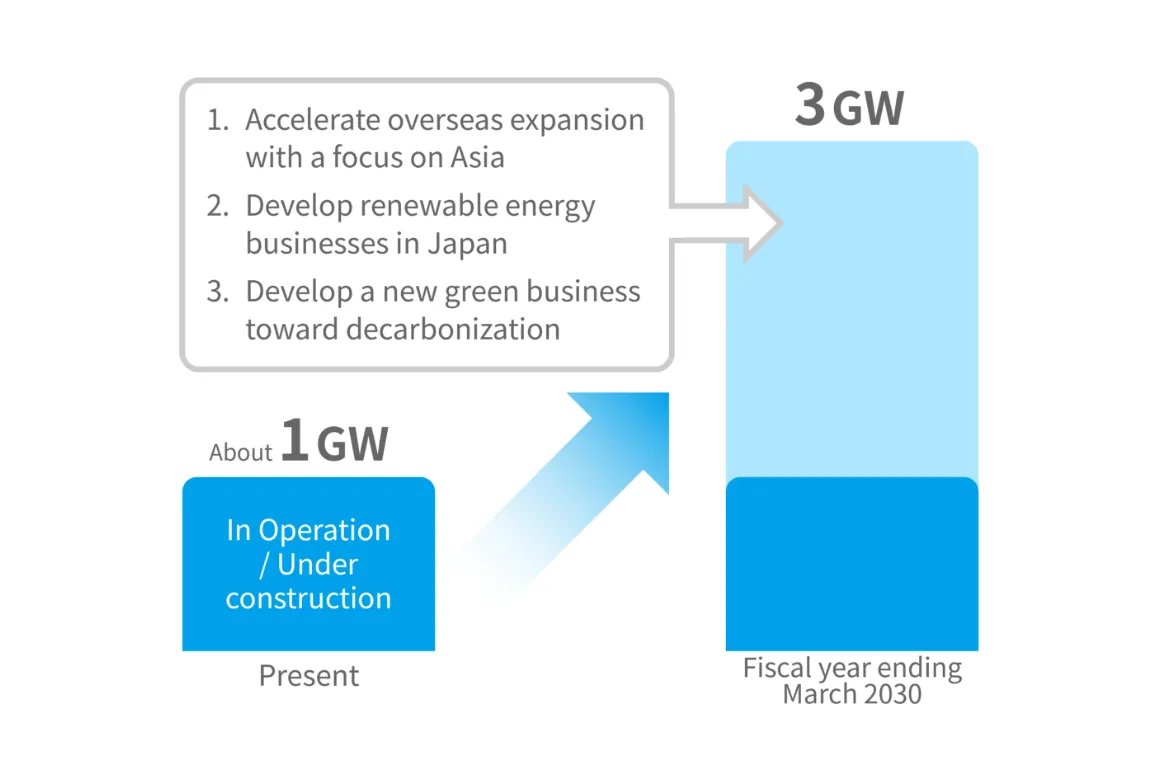

Along with the global enforcement of the policy to expand the adoption of renewable energy, RENOVA set its vision, become Asia’s renewable energy leader, seeking to expand renewable energy in Asia, including Japan, and to realize greater decarbonization.

Risk Management

The main climate change-related risks drawn from scenario analyses are reported and discussed in the Risk Management Committee, and responses and policy are determined.

The status of all responses is tracked and managed using a plan–do–check–act (PDCA) cycle.

In addition, the Board of Directors make decisions in light of climate change-related risks and sustainability, including investment decisions concerning the development of renewable power plants.

Metrics and Targets

With a mission of creating green and sustainable energy systems for a better world,” RENOVA is fully dedicated to contributing to reducing CO2 emissions through the development of renewable power plants and the expansion of the scale of their operations toward decarbonization.

| Item | Target | Target Year |

|---|---|---|

| Contributing to society by reducing CO2 emissions | A cumulative total of 10 million tons | 2030 |

| Item | Contributing to society by reducing CO2 emissions |

|---|---|

| Target | A cumulative total of 10 million tons |

| Target Year | 2030 |